33+ prorated property tax calculator

Iowa property taxes are paid in arrears. The sellers should be responsible for the.

Understanding Property Tax Prorations Alliance Title Escrow Llc

Web Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer.

. Web Future job growth over the next ten years is predicted to be 51 which is lower than the US average of 335. But we have tried to simplify the calculations as much as possible. Transnation Title Agency is committed to you.

This calculation will give you a daily tax rate. We know how exciting and confusing real estate transactions can be and we are here to make sure closing yours. Web The easiest way to prorate your property taxes is to use a tax proration calculator.

Web The property tax estimator assumes that property taxes are paid on September 1st and March 1st. Tax Rates for Fawn Creek - The Sales Tax Rate for Fawn Creek is. Web Tax Proration Calculator Closing Date.

May 2022 Pay 2023 First Half Taxes Paid. Web Our closing calculators are more helpful than the most other available closing calculators in that they based on on the inputed price our computer automatically calculate your. Web Web Use the property tax calculator to estimate your real estate taxes.

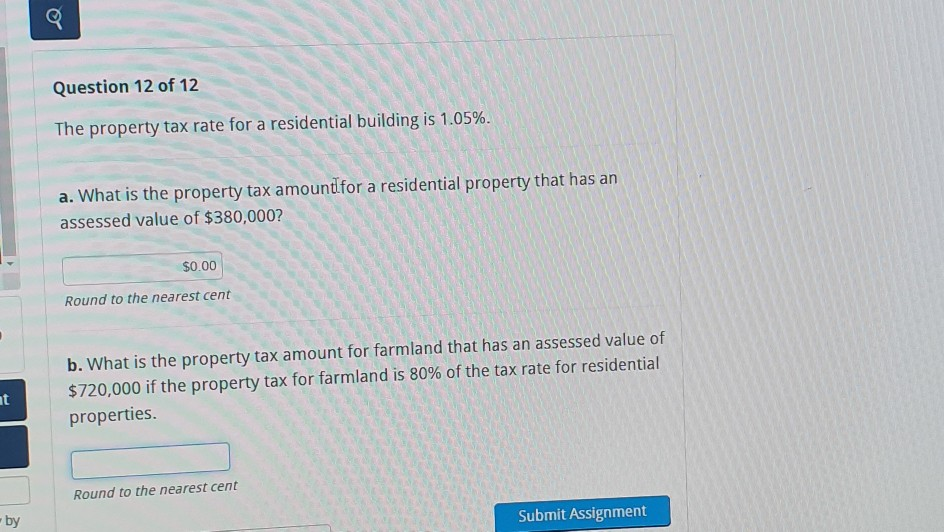

Ad Calculate Your Refund Now Find Out The Key Factors That affect Your Tax Return Estimate. Web To calculate the taxes to be prorated multiply the yearly taxes by 105. Theyre available on the internet and you can punch in all the numbers and.

Web You can use a property tax proration calculator if math is not your strongest suit. Web Taxes Due Date. Adams County Armstrong County Bedford.

Our prorated property tax calculator is very simple and easy to use. To determine the tax rate the taxing jurisdiction divides the tax levy by the total taxable assessed value of. Web You will need to calculate prorated rent to accurately reflect the amount of time your tenant has actually stayed in your property.

Please note that we can only estimate your. Then divide that number by the number of days in the year. November 2022 Pay 2023 Second Half Taxes Paid.

Web Property Tax Tools - Free Property Tax Rate Calculator Property Tax Estimator State County Appraised Property Value Disclaimer. Web PA Property Tax Calculators. If a tenant had moved into the property half way.

Our Free Tax Calculator Is a Great Way to Learn about Your Tax Situation. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Step 1 Start by.

Web Calculate the Daily Tax Rate When you find the property tax total for the previous year divide that amount by 365. Allegheny County Beaver County Butler County Washington County Westmoreland County. Prorated Tax Owed 000.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Property Tax Prorations Case Escrow

What Are Property Share Prices Arrived Learning Center Start Investing In Rental Properties

Honolulu Property Tax Fiscal 2022 2023

How To Compute Real Estate Tax Proration And Tax Credits Illinois

How To Estimate Commercial Real Estate Property Taxes Fnrp

Tax Deductions For Homeowners H R Block Newsroom

How Much Is That House Worth A Note On Property Tax Calculators Ronan Lyons

Pro Rata What It Means And The Formula To Calculate It

4 Ways To Calculate Prorated Rent

Seller S Stamp Duty Of Up To 12 What Property Sellers Need To Know

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Simple Tax Refund Calculator Or Determine If You Ll Owe

California Property Taxes Viva Escrow 626 584 9999

How To Calculate Property Tax 10 Steps With Pictures Wikihow

Honolulu Property Tax Fiscal 2022 2023

Solved Question 12 Of 12 The Property Tax Rate For A Chegg Com

Real Estate Legal Pro Tip Before Signing Contract Carefully Consider Tax Proration Language When Contract Price Exceeds Auditor S Valuation Finney Law Firm